Best Motor Vehicle Insurance Companies in Kenya

Introduction

Motor vehicle insurance is a very critical aspect of car ownership. It helps protect against unforeseen circumstances e.g. theft, accidents and even damage to the car or its occupants. The Government of Kenya through the Insurance Regulatory Authority has made it mandatory for every car to have insurance.

In Kenya, drivers must have car insurance. It’s a legal rule and helps financially in accidents. The insurance covers repair, medical, and other costs. This prevents sudden money troubles. Choosing an insurer can be hard due to many options. It’s tough to find the best service, coverage, and prices. Research is crucial. Look at the coverage, company reputation, service, premiums, and extras. We’ll focus on these factors to help you decide.

Understanding Kenyan Car Insurance

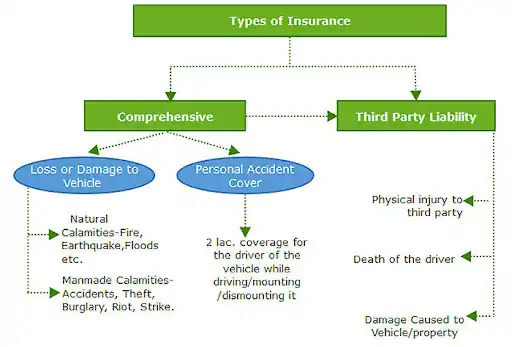

Kenya offers three main car insurance types. First, Third-Party Only (TPO) is basic and required by law. It covers damage or injury to others in an accident, but not your car or injuries. Second is Comprehensive insurance, which is the most extensive. It covers accidents, fire, theft, and natural disasters. It also covers third-party damages. Finally, there’s Third-Party, Fire & Theft (TPFT). This option is in the middle. It includes TPO’s benefits and adds protection for theft and fire. So, if your car is stolen or burned, the insurance will help. However, like TPO, it won’t cover your car’s other damages.

Types of Motor Car Insurance

a) Third-party insurance

This is the minimum requirement for motor vehicle insurance and it covers liability for bodily injury or death and property damage caused to third parties. However, it does not cover damage to the insured vehicle.

b) Comprehensive Insurance

this type of insurance provides extensive coverage, including third-party liability as well as coverage for damage to the insured vehicle. It covers accidental damage, theft, fire, natural disasters, and other non-collision events. This type of insurance is recommended for owners of new or high-value vehicles.

c) Third-Party, Fire, and Theft Insurance

This insurance type offers coverage for third-party liability, fire damage, and theft of the insured vehicle. It provides a middle ground between TPO and comprehensive insurance.

Others include;

d) Motor trade insurance

This insurance is designed for businesses involved in the motor trade industry, such as dealerships, garages, or repair shops. It provides coverage for vehicles owned by the business, including those in transit and those being tested or repaired.

e) Personal accident cover

This optional coverage provides financial compensation for injuries or death to the driver and passengers of the insured vehicle. It can be added as a rider to the main motor insurance policy.

f) Fleet insurance

Fleet insurance is designed for businesses or individuals with multiple vehicles. It allows for the consolidation of coverage for multiple vehicles under a single policy, simplifying administration and often providing cost savings.

Factors to Consider When Choosing a Car Insurance Company in Kenya

1. Financial Stability and Reputation

A financially strong company is more likely to pay claims. Avoid those that may not. Also, look for positive customer reviews, which suggest good service. To check financial stability, visit the Insurance Regulatory Authority (IRA) website. There, you can find detailed reports and ratings. Additionally, read online reviews to learn about others’ experiences.

2. Coverage Options and Flexibility

Understanding car insurance options and flexibility is key. Companies offer damage coverage, liability, and extras like accident or theft protection. These plans vary in protection and benefits. Some companies also offer flexible plans. You can tailor your policy to your needs. For example, you might want excess buy-back or roadside assistance. This way, you get the right protection for your situation.

3. Claims Process Efficiency

Make sure its claiming process is smooth and efficient. After an accident, you want quick, hassle-free claim processing. Consider online claiming. It saves time and effort. Also, check the processing time. Make sure customer support is good. You should feel confident. Some companies provide dedicated claims advisors or 24/7 helplines. This makes the process easier and more reassuring.

4. Technology Integration and User Experience

Technology has enabled many car insurance companies to launch online platforms and apps. These tools improve user experience by simplifying policy management, quotes, and claims. They boast a friendly interface that saves time and reduces frustration. Key features include easy navigation. They have clear information. You can use them to renew policies or track claims online. Managing car insurance from a phone or computer enhances satisfaction.

5. Price Competitiveness

Consider more than just cost when choosing insurance. Look for quality too. Cheaper options might save money initially but could leave you underinsured later. To find the best deal, get quotes from different companies and compare them. Check the coverage and benefits of each policy. The goal is to get comprehensive protection at a fair price. Prioritize value over the lowest cost. This ensures you get the right coverage without sacrificing quality.

10 Insurance companies in Kenya

There are many insurance companies in Kenya and picking the most suitable one for your car can prove a difficult task. We have compiled for you a list of some of the best insurance companies in Kenya and what they offer.

A top insurance provider in Kenya provides a wide range of insurance-related goods and services. Kenyan consumers trust CIC Insurance because of its reputation for flexibility and creative problem-solving, as well as because of its integrity, client satisfaction, financial stability, dependability, and effective claims handling. Their policies, which concentrate on motor insurance, offer choices like Third-Party Only (TPO), Comprehensive Insurance, and more to meet the varying needs of car owners.

(Contact them at CIC Plaza, Mara Road, Upper Hill, Nairobi, Kenya. Tel: 0703099120, Email: callc@cic.co.ke.)

APA Insurance is a well-known supplier in Kenya that offers a comprehensive range of insurance services suitable for both individuals and companies. APA is a well-known insurance company in Kenya that specializes in providing comprehensive motor insurance solutions. These solutions include comprehensive insurance, motor trade insurance, and fleet insurance, in addition to third-party liability coverage. APA is the pinnacle of perfect insurance solutions, having a strong financial base and a history of dependability and openness.

(Address: Apollo Center, 07 Ring Road, Parklands, West lands, Tel no: 0722276556/0733676556, Email: info@apalife.co.ke)

With a well-known reputation built over many years of business, Britam provides a full range of financial services and insurance products to meet the various needs of people, companies, and organizations. They provide property insurance, health insurance, life insurance, auto insurance, and retirement planning services, among other things. Britam continues to be a reliable partner for insurance and financial solutions, offering its clients financial security and peace of mind through a vast network of branches and agents across Kenya.

(Address: Britam Center, Mara Ragati Road, Nairobi, Tel No: 0705100100, Email: info@britam.com)

Jubilee Insurance has established itself as the go-to partner for Kenyan individuals and companies looking for comprehensive insurance solutions thanks to its more than 80 years of distinguished experience as the country’s top insurance provider. The company has also solidified its reputation for stability and a wide range of insurance services. Jubilee Insurance provides a range of insurance services, including but not limited to auto insurance options like full coverage, third-party liability, and customized policies for various vehicle makes and models.

(Address: Jubilee Insurance Center, Wabera Street, Tel no: 020328100, Email: info@jubileekenya.com)

Direct Line Insurance is a prominent player in the insurance market, especially for matatu businesses. Being the best fleet insurance provider in the country, it is well-known for its superiority. Direct Line Insurance prioritizes client satisfaction by providing a variety of comprehensive motor insurance options, including comprehensive coverage, specialized options, and third-party liability. Competitive rates, adaptable coverage options, and cutting-edge products designed to give customers peace of mind across Kenya are all clear indications of its dedication.

(Address: Hazina Towers, 17th floor, Monrovia Street, Tel no 0711030000/0730130000, Email: info@directline.co.ke)

PACIS Insurance offers various products. These include motor, medical, and property insurance. The company is known for its focus on customers and solid financial support. Also, it provides tailored motor insurance. This ensures all customers get reliable coverage and peace of mind.

(Contact: PACIS Centre, Waiyaki Way, Westlands, Nairobi. Tel: +254 730 677 000. Email: info@paciskenya.com)

Cannon Insurance offers motor, health, and life insurance. It focuses on flexible motor insurance, covering third-party and comprehensive options. The company stands out for its good customer service and financial strength.

(Contact: Gateway Business Park, Mombasa Road, Nairobi. Tel: 0203966000. Email: [info@cannon.co.ke]

🚗 Compare & Save on Car Insurance in Kenya!

Get the best car insurance deals in Kenya at unbeatable rates. Compare top insurers, find the perfect policy, and apply in minutes! Don’t overpay—secure your coverage today.

🔍 Compare The Best Car Insurance Now

UAP Old Mutual Insurance offers various products, including motor insurance. It provides full coverage, with options like third-party and comprehensive plans. Also, the company is known for its solid finances and excellent service.

(Contact: UAP Old Mutual Tower, Upper Hill, Nairobi. Tel: 0202850000. Email: customerservice@uap-group.com)

First Assurance Company Limited offers motor, health, and property insurance. It provides complete motor insurance for your vehicle. The company is known for its reliable service and strong finances.

(Contact: First Assurance House, Gitanga Road, Nairobi. Tel: +(254) 709 544 000. Email: info@firstassurance.co.ke)

Heritage Insurance Company offers motor insurance. It has options for third-party and full coverage. The company has excellent customer support and a strong financial foundation.

(Contact: Liberty House, Mamlaka Road, Nairobi, Tel: 0711028000. Email: info@heritage.co.ke)

Conclusion

An essential function of motor insurance is to protect car owners against monetary obligations resulting from theft and accidents. With so many insurance options available, both individuals and companies can choose plans that fit their specific needs and budget. As a result, it is necessary for car owners to carefully consider their insurance requirements, carefully consider their options for coverage, and carefully review policy details to ensure complete protection and compliance with legal requirements. By obtaining reliable motor insurance, people can travel Kenya’s roads with confidence knowing that they will always have financial support in the event of emergencies or unanticipated accidents.